Starting your eCommerce business – what are your payment options?

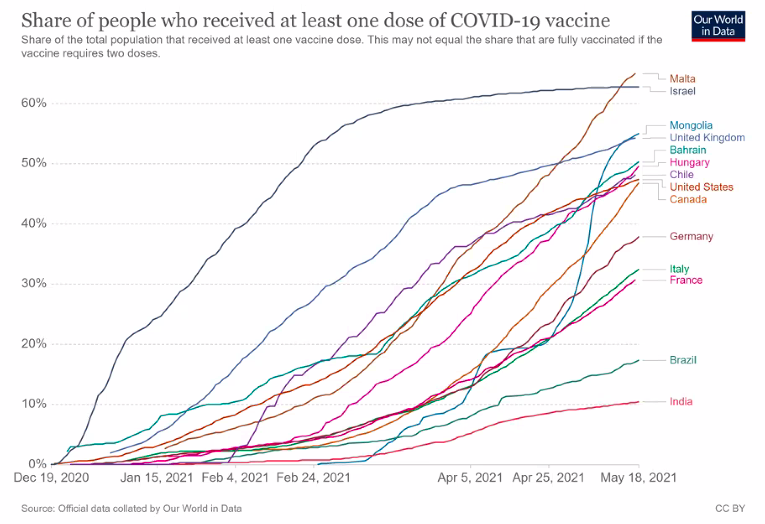

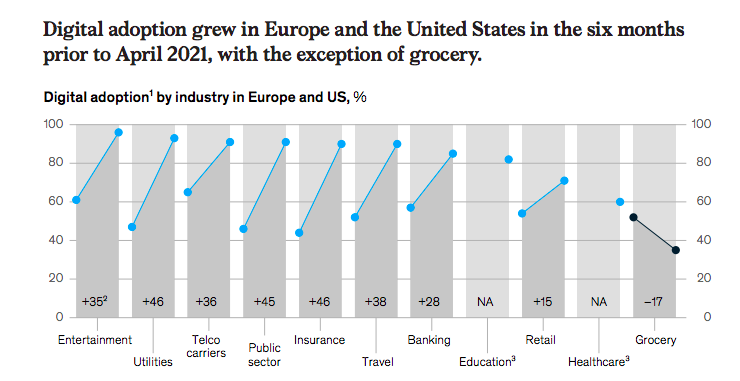

Over the last year, eCommerce sales have grown substantially, mainly boosted by the global pandemic. In Malta, half of the population now buys online and as much as one third do so for their daily needs.

With this increase in online transactions, businesses learned that customers require more flexibility in terms of how they pay online.

While many technical aspects of setting up and running an e-Commerce website are relatively straightforward, finding the right payment solution can often be daunting for a business that’s just starting out.

Payment considerations for new businesses

Most new businesses are familiar with the traditional credit card processing services that are now part of most e-commerce solutions. However, with the emergence of a multitude of mobile payment methods like Apple and Google Pay and alternative payment methods like e-wallets, businesses are finding it challenging to keep up with their consumers.

In retail, most point-of-sale devices (POS) have been digitised, and businesses need to consider payment solutions that seamlessly work in-store and online, all while communicating with each other.

The first thing businesses should determine is what combination of payment solutions would suit them best. At the same time, they need to choose a payment solution that would offer them the flexibility of adding new payment options in keeping with the customer trends.

Top online payment solutions

Here are the most common payment solutions for your growing business:

Card Payments

Whether debit, credit, or prepaid – cards are still the most popular way of paying for goods and services online. To set up card payments on your eCommerce website, you need an Internet merchant account – this could be managed by your bank or by a payments service provider (PSP) such as Trust Payments.

Bank Transfers

Bank transfers are not a novelty in payments, but they are still seen as an essential payment method in eCommerce, especially for industries like travel and hospitality. It is still seen as one of the most secure methods as the transactions need to be approved and authenticated by the customers.

E-wallets and Cardless Payments

This payment type requires customers to register for an account with a provider like PayPal, AliPay, or the well-known ApplePay and GooglePay. Their accounts are linked to their credit cards – this is convenient for the customers as they can pay for anything online without having to remember card numbers.

Online Payments Gateways

An online payment gateway is a service devised to send and receive payments – an out-of-the-box eCommerce payment solution. This type of payment solution can easily integrate with any e-Commerce platform and provide your business with the latest payment technology (including bank transfers and e-wallets) and real-time currency conversion. It can even offer a hosted payment page that can be customised with your company’s brand.

But what if your business does not have a customer-facing eCommerce website yet? The online payment gateway will support you with a pay-by URL (an internet link) that your business can send to customers via email, messaging platforms like WhatsApp and Facebook Messenger or SMS.

A crucial feature that often gets lost in the shuffle when choosing payment processors is security. Many merchants prefer to accept credit or debit card payments for the convenience of cutting out the banking procedures, but using an online payment gateway like Trust Payments’ TRU Connect will equip your business with an advanced AI-powered protection Fraud Check and 24/7 customer support.

Offline Payment Options

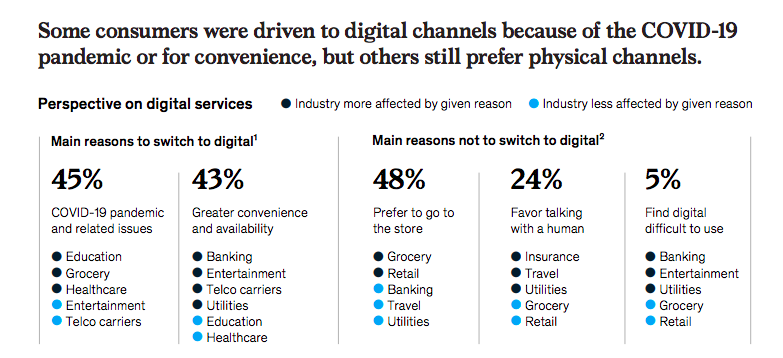

Customers are used to placing orders online but many in Malta still prefer a cash-on-delivery payment method. It’s important to monetise your website and keep sales as flexible as possible to cater to these customers.

Why variety is important

Providing choice on payments is about appealing to customers and will ensure that they don’t abandon their online purchases because they can’t use their preferred payment method. Moreover, multiple payment methods provide a more seamless customer experience and increase online purchase orders.

This is why businesses need to balance the resources required to offer and manage multiple payment methods and consider that some payment methods may come with higher transaction fees than others.

Partnering with a payments service provider when starting your eCommerce business is crucial so you can tailor the payment options to your business objectives and your budget – this will truly bring out the best checkout experience to your customers.

Trust Payments is an international company with offices in Birkikara and over 100 local team members. We are very happy to take your call today on 2226 7444 to discuss more how we can help you.