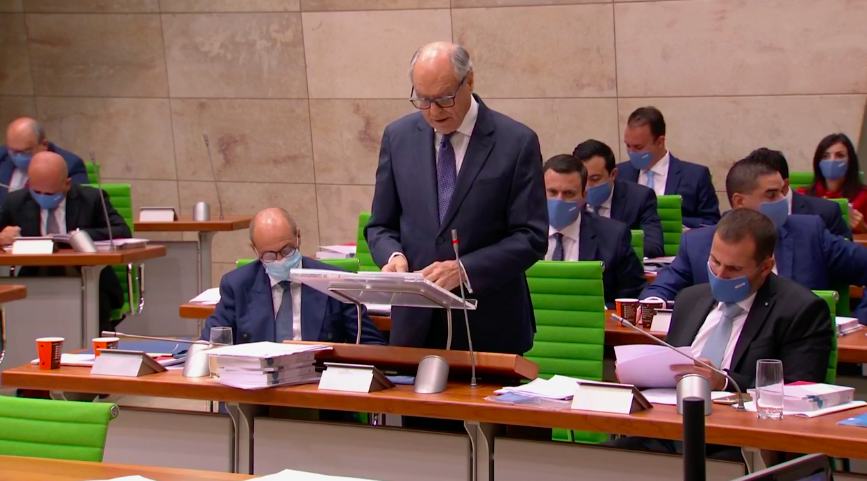

The Malta Chamber of SMEs has come to members, immediately following the Budget 2021 announcements, with a discussion with Malta Enterprise CEO, Mr Kurt Farrugia, to shed light on a number of measures mentioned in the Budget, the idea behind them and what to expect in the coming days, weeks and months.

Below we have included the main budget highlights as well as the added value information that we have up till today.

Vouchers

Budget announcement: Another round of vouchers is set to be issued. The vouchers will be divided in more of an equal manner – 60 for hotels, restaurants, accommodation and 40 for retail and services.

More Information:

The Voucher system will not only be relaunched but will be also wider in scope. Whilst, originally, only the businesses that were forced to close by order of the Health Authorities due to Covid, were able to register to take part in the voucher scheme, the next round will give greater opportunities for new businesses to participate since other sectors that were not ordered to close where in reality still closed as they were seeing no business at all. The voucher new voucher scheme should therefore be open to all businesses that have suffered severe loss of business during Covid.

The SME Chamber is currently in discussions with the government on the best time to re-launch the new set of vouchers.

Wage Supplement

Budget announcement: Extended till end of March 2021 and will be revamped to ensure those businesses needing the help most will be getting it.

More Information:

The wage supplement will be taking a fairer assessment of how businesses were impacted by the pandemic. The government will therefore be moving away from the nace code system and assessing actual impact. One way being discussed is to calculate the impact of the reduction based on change in turnover year on year. It is still unsure which type of business return or otherwise will be utilised but the ultimate aim is to ensure that those businesses hit the worst by the pandemic get the best in terms of aid and others will get an amounts that is relative to their impact.

The new Wage Supplement will not add any bureaucracy to businesses and will also be worked in a way to make it easy for Malta Enterprise to evaluate. Any changes put in place in the Wage Supplement will be discussed with the Chamber of SMEs as social partner.

Apart from being extended till end of March, there will also be a possibility to integrate new employees on the wage supplement. The mechanics and eligibility of this is still being discussed.

New Malta Enterprise Innovation Scheme

Budget announcement: Malta Enterprise to issue a scheme targeted at productive investment. This scheme will be open to businesses employing less than 50 employees that choose to embark on innovative projects including tech investments to improve their operation in terms of efficiency and cost, assistance in finding new markets and employing qualified employees. The scheme will be open for a duration of 1 year and will finance 50% of the investment up to Eur 200,000. The aid will increase by an additional Eur 35,000 if the investment is carried out in collaboration with a research institute.

More Information:

In terms of how to calculate the 50 employees, the likelihood is that companies will be taken individually in terms of the calculation and not altogether as a group.

Mainly targeted at the manufacturing sector to regenerate and reinvent business functioning through innovative systems and upgrades. This includes Industry 4.0 and the Internet of Things, increase sustainability, coming up with a new product, investing in new IT systems, etc.

eCommerce

Budget Announcement: Help for businesses selling online and amalgamation with distribution systems.

More Information:

A wider scheme in terms of targeted business audience that will continue supporting businesses to have access to the different tools necessary to successfully sell online.

Industrial Areas

Budget Announcement: €450M for the coming 7 years for new spaces for businesses – Including spaces for SMEs and new Logistics Hub

More Information:

Capital expenditure in new industrial spaces to ensure we have enough industrial capacity so that industry finds the physical space they need. These are not office spaces – which are abundantly available, but state-of-the-art business incubation areas for innovative local and foreign businesses in life-sciences and the digital sphere.

Export and Foreign Markets

Malta Enterprise CEO Kurt Farrugia also mentioned the increased importance and potential he is seeing in nearshoring and the increased focus on forming our own new ideas at local level and supporting indigenous Maltese businesses to grow. Mr Farrugia emphasised on the need to lower our country’s reliance on Chinese and South Asian imports. Instead Malta Enterprise will be supporting tapping into new markets of great potential to export which certainly includes Africa.