Proposals were presented during a Press Conference on Monday

The Malta Chamber of SMEs has today publicly launched its Budget proposals for 2022. A total of 26 proposals were presented which aim at accelerating the economic recovery, help businesses become future proof, support those businesses still heavily suffering the effects of Covid and to help Malta move into normality.

The full set of proposals can be found here. The below is a summary of the main proposals presented:

-

Widening of existing tax brackets

Extending the middle 25% tax bracket for up to Eur 100K income to help businesses in their recovery.

-

Removal of SISA

Exercise to be removed for all goods that do not carry the excise identifier marker to avoid unfair competition.

-

Rescue package for worst COVID hit businesses

Extending existing moratoria and lengthened repayment periods.

Extended Covid Support Assistance – Wage Supplement, Rent, Electricity.

Scheme for converting accumulated debt due to the Covid impact into a non-repayable grant based on specific criteria.

Aggressive grants to support the strengthening of the business to the post-Covid scenario – Refurbishments, change in business structure, marketing, re-employment, stocks.

-

Addressing the adverse banking environment

Banking services supervision through the setting up of a task force with the ultimate aim of establishing a Charter for Banking Services and the appointment of a separate Banking Services Supervisory Board that will act as a redress mechanism for disproportionate action or treatment.

The government is also asked to attract more competition in the banking sector.

-

The Workplace

The SME Chamber is calling for a revamp of the quarantine financial mechanism and the legalisation of requesting information about vaccine status and travel plans at the workplace.

a. Unvaccinated employees by choice would not be eligible for any quarantine leave

b. No Quarantine leave for travellers to areas where quarantine will be necessary upon their return

c. Legalise the requirement to share information – Vaccination and Travel

Incentives for employers to create safe and professional team building activities to mitigate increase in mental health and marginalisation issues.

-

Accredited Training

A full financed training scheme based on the training necessities of employers. With resources being very limited at the moment a strong incentive is necessary in order to increase training levels.

-

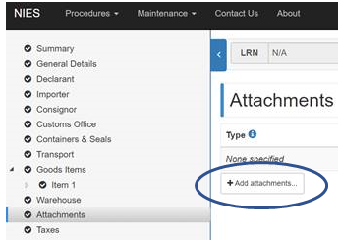

Digitlisation Strategy

A grant scheme that would help businesses cover costs linked to the successful execution of a website. This includes:

d. Building/updating/replacing of content which includes products or services for sale.

e. The optimization of client experience

f. Linking the site to stocks and having a fully fledged integrated system that can also include the upgrade of the point of sale system and backend functions

A scheme specifically aimed at raising awareness and supporting businesses investing in cyber security via a tax-credit.

-

Reforming MicroInvest

50% of the eligible tax credit convertible to a (Max. Eur 5,000) grant.

Extend the duration to use tax credit from 3 to 5 years.

Increase capping from 50K to 70K for all businesses and from 70K to 90K for businesses currently falling under the preferential category.

-

Imports & Exports

Addressing the high shipping costs at Macro Level through discussions at the EU to negotiate matters as a continent, and at Member State level to negotiate shipping agreements that would reduce importation costs.

Incentives that would help local businesses produce products previously imported in a sustainable manner.

Malta to present its case at EU level to get specific exemptions on Brexit procedures.

Incentivise Exports to Africa through a state facilitated Guarantee Scheme or Insurance.

-

Mitigating the Greylisting

Compliance authorities to implement enforcement fairly and to focus on educating and supporting users to increase compliance.

A specific grant should be made available for CSPs and other service providers to invest and upgrade their due diligence system.

-

Carbon-neutral Strategy

More aggressive grants for the private sector to purchase EVs and creating opportunities for companies to invest in multiple charging stations in several spots, including fast chargers within the business.

Greener Special Type vehicles scheme should include the possibility to upgrade fleets to the latest Euro Engine.

Scrappage scheme should be extended to vehicles which are not for private use.

-

Gozo

Proposal for Gozo include a clear ban on the development in ODZ areas as swell as a scheme to renovate unutilised properties. A mutli-storey car-park in Victoria and incentivising clean transport by reduction the ferry cost for Maltese residents with electric vehicles and having the installation of electric chargers in all villages.